Bills & Payments

The Bills & Payments section is a key feature in the Identity Management and Store system, helping users manage financial transactions related to services.

Main Features of Bills & Payments

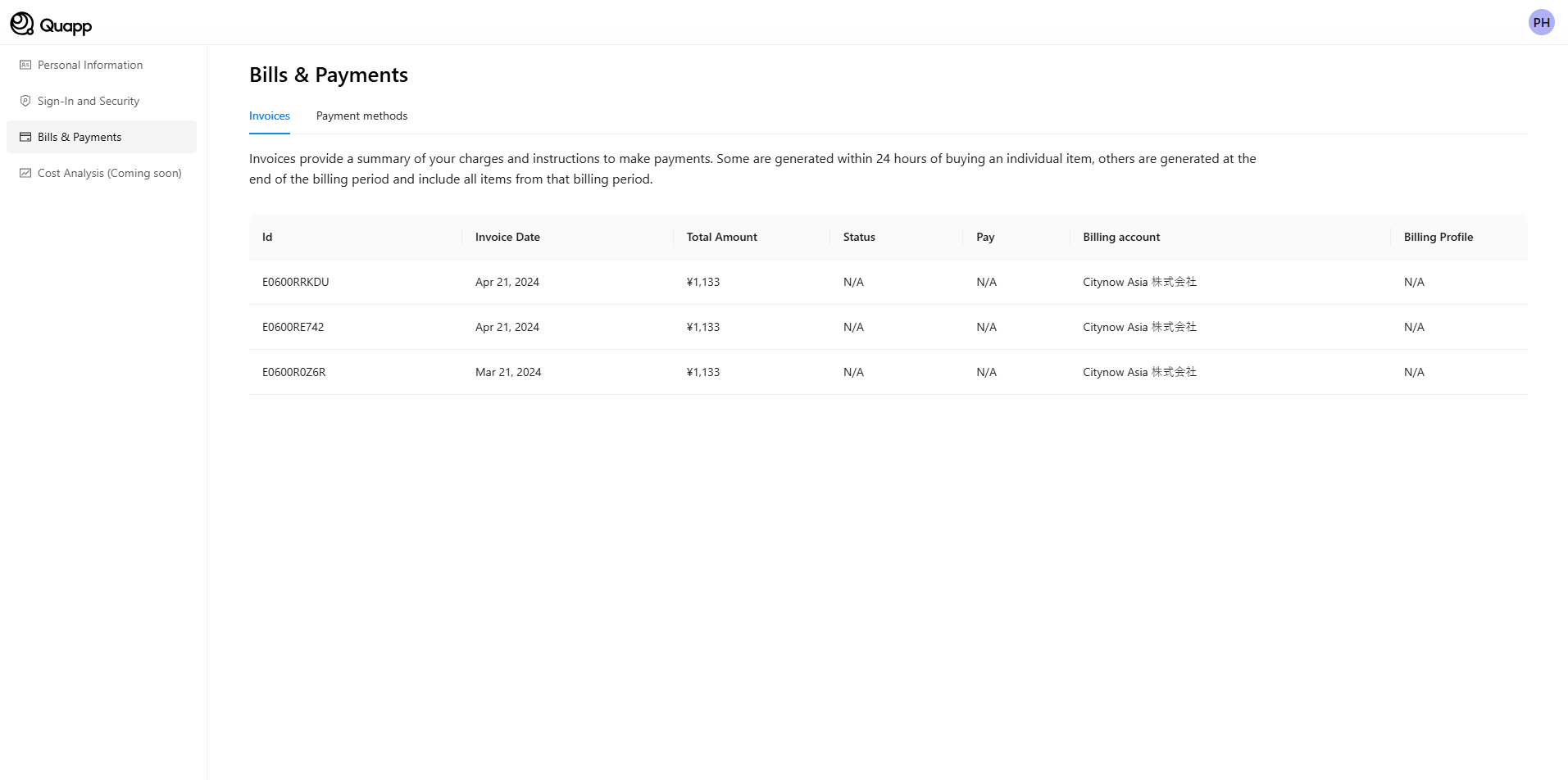

1. Invoices

Purpose: Invoices provide a detailed summary of the charges that the user needs to pay. These invoices can be generated after each transaction or periodically at the end of a billing cycle to include all services used during that period.

Invoice Details: Each invoice will include information on the fees incurred, the services used, and instructions on how to make the payment. Invoices may be broken down into smaller charges such as subscription fees, service usage fees, or overage charges.

Payment Instructions: The invoice will include the available payment methods that the user can use to settle the charges. These methods may include credit cards, debit cards, bank transfers, or other online payment methods.

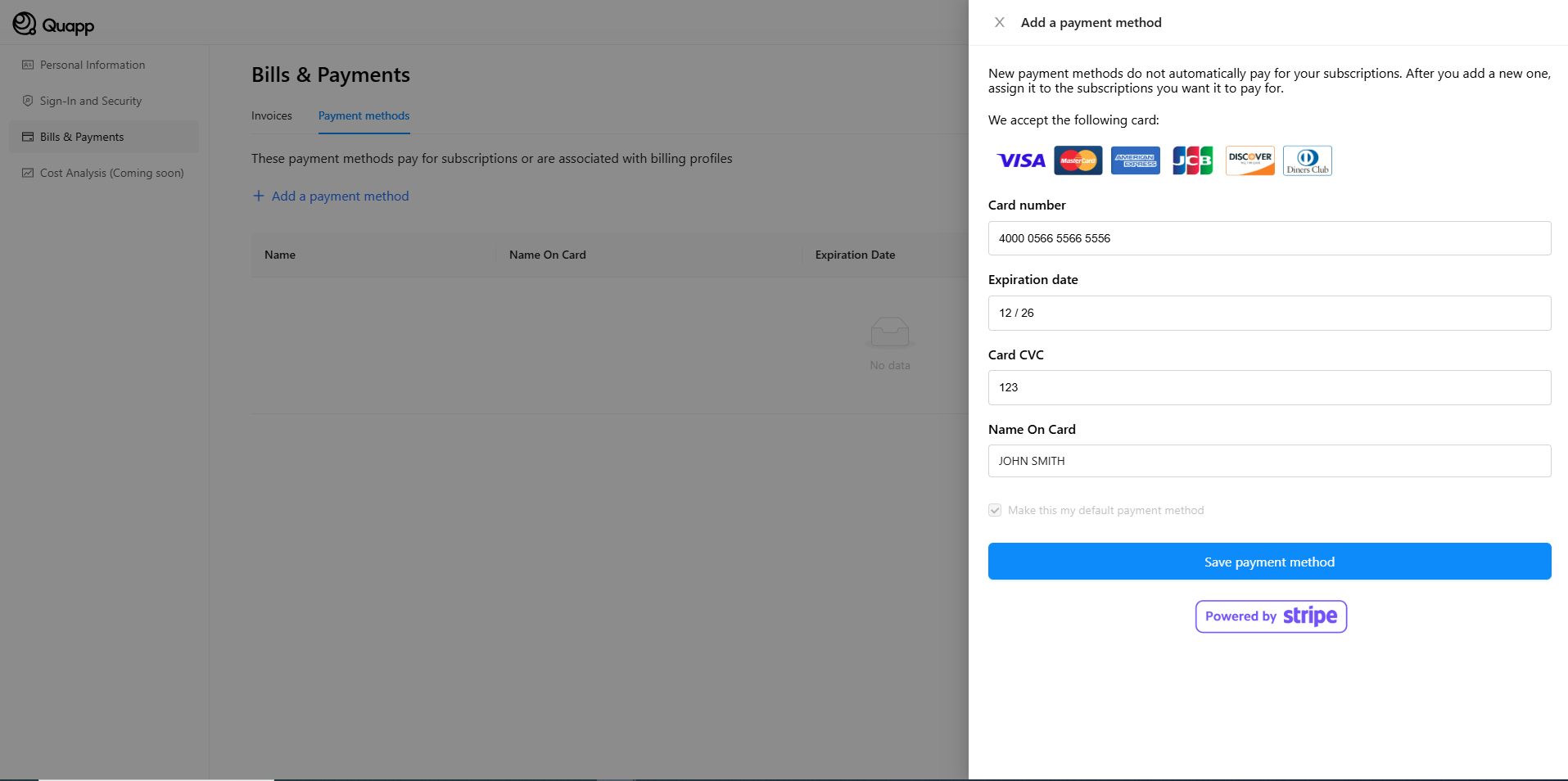

2. Payment Methods

Purpose: Payment methods allow users to pay for the services or products they have used. These methods can be linked directly to the user's account and make transactions fast and easy.

Supported Payment Methods: This section provides information about the payment methods the user has linked to their account. These could include credit cards, debit cards, bank accounts, or e-wallets. Users can add or update their payment methods as needed.

Payment Methods Linked to Billing Profiles: Payment methods can be associated with the user's billing profile, helping to track transactions more easily and make automatic payments for recurring services such as subscriptions, memberships, or long-term service plans.

3. Billing Profiles

Purpose: Billing profiles help users manage their payment information in one centralized space. These profiles include details about the user's payment methods and any transactions associated with their account.

Managing Billing Profiles: Users can update or add new payment methods to their billing profiles. This makes it easier to track spending and payments for the services or products they are using.

Managing Recurring Services: Billing profiles may also be linked to recurring services that users have subscribed to, such as monthly or annual plans. Users can track and make payments for these services automatically.---

Managing Invoices and Payments

1. View Invoices

- Users can view all invoices that have been generated for their account. The system provides a list of invoices, including detailed information about the fees and payment status. Invoices can be sorted by date or payment status (paid, unpaid).

2. Make Payments

- Users can make payments directly from the invoice page. The system will display the available payment methods and allow the user to complete the payment transaction immediately. After payment, users will receive a confirmation, and the invoice will be marked as "paid."

3. Generate Recurring Invoices

- For services or products with a recurring payment cycle (e.g., monthly subscriptions), the system will automatically generate invoices at the end of each billing cycle. Users can see a summary of all charges for each cycle and make payments once the invoice is created.---

Benefits of Bills & Payments

1. Easy Financial Management:

The Bills & Payments section helps users track all financial transactions related to their account, including service charges, product payments, and other costs. Users can get a clear view of the money they've spent and the invoices they need to pay.

2. Quick and Convenient Payments:

By linking payment methods to their account, users can pay invoices quickly and conveniently without having to re-enter payment information each time. This saves time and reduces errors during the payment process.

3. Security and Safety:

Payment methods and invoice information are protected with strict security measures to ensure that users' transactions are always safe. The system uses encryption to protect sensitive information and prevent data breaches.

4. Automatic Notifications and Alerts:

The system can send notifications to users when a new invoice is created, when there is a change in their payment method, or when a new transaction occurs. This helps users stay on top of important financial events and manage their payments proactively.